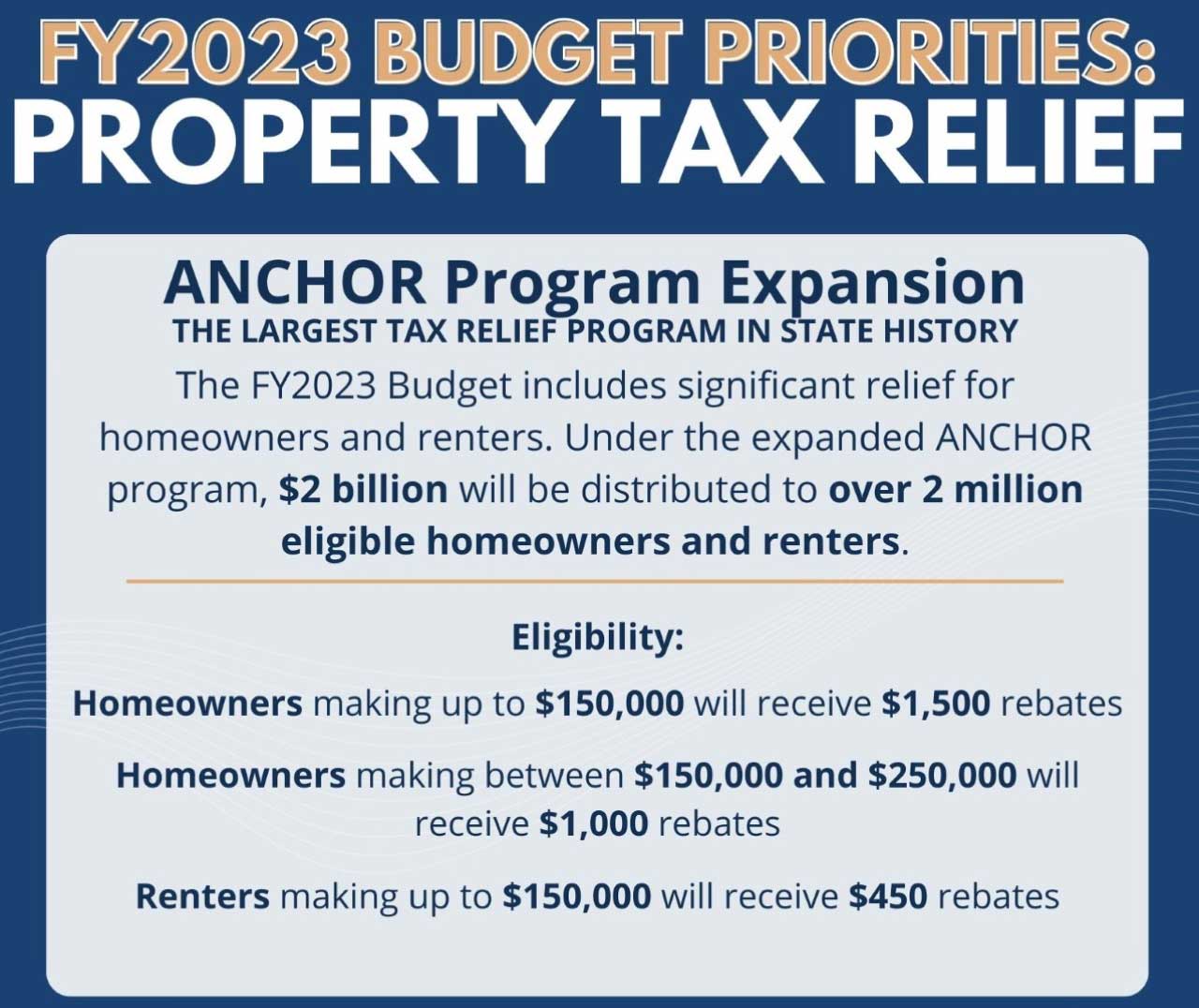

Property Tax Relief

The ANCHOR program is the largest property tax relief PROGRAM in New Jersey history

The ANCHOR program, signed into law on June 30, 2022, will provide $2 billion in property tax relief for homeowners and rebates for renters.

Homeowners with household incomes below $150,000 will receive a $1,500 property tax rebate, and homeowners with a household income between $150,000 and $250,000 will receive a $1,000 rebate.

More than 900,000 renters with household incomes below $150,000 will receive a $450 check from the State.

You may also qualify for other property tax relief benefits. For a full list please visit this link.

Senior Freeze (Property Tax Reimbursement)

The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax increases on their principal residence (main home). NJ residents who owned and occupied a home in NJ that was their principal residence on October 1, 2017 may be eligible to qualify for this program—provided property taxes were paid and income limits are met. Call the NJ Senior Freeze Hotline 1-800-882-6597 for further assistance. You may also visit nj.gov/taxation.

Deductions, Exemptions, and Abatements

The State of New Jersey offers several property tax deductions, exemptions and abatements. These programs are managed by your local municipality. Click on the below links to learn more about what deductions you may qualify for:

- $250 Property Tax Deduction for Senior Citizens and Disabled Persons;

- $250 Veteran Property Tax Deduction;

- 100% Disabled Veteran Property Tax Exemption; and

- Active Military Service Property Tax Deferment.

Property assessment, exemption, and abatement programs include:

- Automatic Fire Suppression System Property Tax Exemption;

- Environmental Opportunity Zone Property Tax Exemption;

- Five Year Exemption and Abatement;

- Historic Site Property Tax Exemption;

- Non-Profit Organization’s Property Tax Exemption;

- Non-Residential Development Fee Certification/Exemption;

- Renewable Energy System Property Tax Exemption; and

- Urban Enterprise Zone Property Tax Abatement

“There are far too many New Jersey residents still struggling to make ends meet in the aftermath of the worst days of the COVID 19 pandemic,” said Senator Andrew Zwicker (D-Somerset, Mercer, Middlesex, Hunterdon). “The ANCHOR program promises timely relief to millions of homeowners and renters, putting money back into their pockets, and helping to keep our state affordable, and our economy strong and competitive in both the near- and short-term

“Helping people keep up with their bills and giving them more breathing room has never been more important than it is right now,” said Assemblyman Freiman (D-Somerset, Mercer, Middlesex, Hunterdon). “Two billion dollars in direct property tax relief to New Jersey residents is monumental. Taxpayers will see the impact of this kind of investment on their property tax bill and in their wallets.”

“We are all committed to making New Jersey a more affordable state for middle-class families to live in and we are committed to creating opportunities for them to be able to build a better life right where they are. Direct and tangible property tax relief is doing exactly that,” said Assemblywoman Sadaf Jaffer (D-Somerset, Mercer, Middlesex, Hunterdon).